As the Chief Product Officer of Alianza, I recently took the stage to discuss the immense potential for service providers to capitalize on two important cloud communications opportunities. The first is the growing demand for modern communication solutions in the small and midsize businesses market, and the second is the need for communication service providers (CSPs) to simplify operations and focus their limited internal resources on core competencies like expanding the broadband network, instead of non-core activities like running legacy voice networks. With every major research firm predicting a significant revenue opportunity in the cloud communications space, service providers have a chance to maximize revenue retention and growth.

Understanding how our industry has evolved into its current state helps us better identify the massive cloud communications opportunities available to CSPs. Here’s a brief analysis of how the industry got here and where it’s likely to go.

The Voice Evolution Created Cloud Communications Opportunities for Service Providers

In the past, phone companies relied on proprietary electronic systems built on time division multiplexing (TDM) technology from vendors like Nortel, Ericsson, or ALU. Back in the early 2000s, the industry started transitioning off this legacy infrastructure and took a big step towards modernization by adopting early VoIP platforms like BroadSoft, Metaswitch, and Genband, the pioneers of their day. This transition marked a crucial milestone in the evolution of telecommunications technology.

Since the shift began over 20 years ago, the VoIP industry has grown and matured to revolutionize the telecom industry, and there’s no turning back. It is evident that the softswitch era is reaching its end, and I’ll tell you why.

Accelerated Innovation by Over-the-Top UCaaS Vendors

Leading Unified Communications as a Service (UCaaS) vendors like Cisco, Microsoft, RingCentral, and Zoom have made significant inroads into markets traditionally dominated by CSPs by offering compelling and innovative business voice, meetings, and messaging services.

The rapid pace of innovation from these UCaaS vendors poses real challenges for CSPs whose offerings are based on legacy softswitch technology. Softswitch vendors have struggled to keep up with the evolving landscape and rapid pace of innovation and, subsequently, CSPs leveraging those platforms have fallen behind as well.

A Shifting UCaaS Landscape

As legacy softswitch-based offerings have become less competitive, vendors started consolidating. Notably, Ribbon acquired Genband in 2017, Cisco acquired BroadSoft in 2018, and Microsoft acquired Metaswitch in 2020. This series of acquisitions set the stage for a transformative series of events.

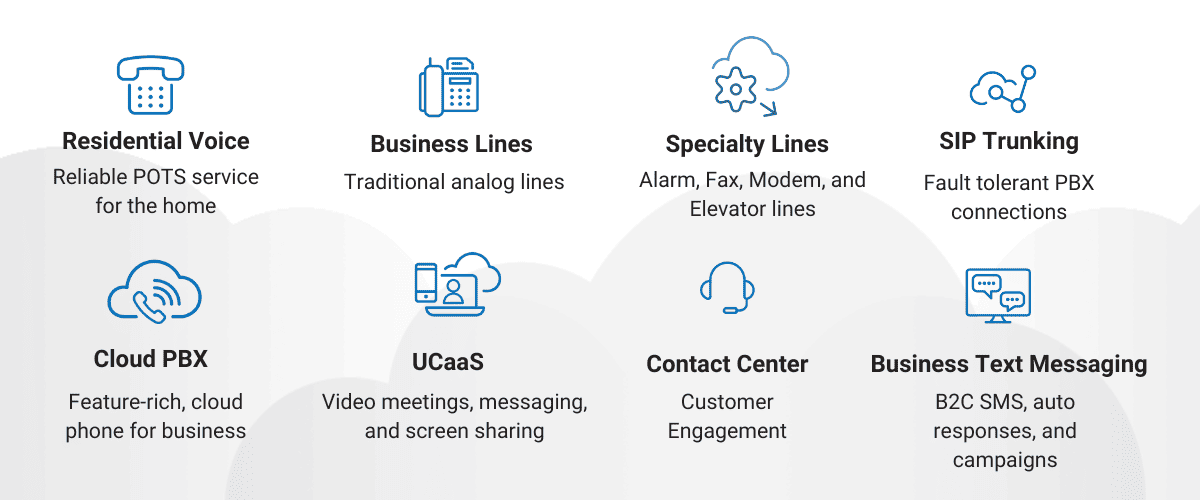

Each of these four major UCaaS providers made the strategic decision to focus primarily on the knowledge worker market segment. The shift toward UCaaS, particularly by Cisco and Microsoft, means they are de-focusing their efforts on market segments served by traditional CSPs, including residential home phone, analog business lines, and other voice-centric services like SIP trunking and cloud PBX without messaging and video.

Traditional Telecom Services Gap

In addition, Microsoft Teams and Zoom began asserting their dominance in higher segments of the UCaaS market, gaining strong footholds in the virtual meetings and enterprise messaging spaces, which placed significant competitive pressure on Cisco and RingCentral. Undeniably, these substantial changes within the UCaaS landscape have markedly shaped its current competitive dynamics and the cloud communications opportunities available to CSPs.

What this ultimately means is that there is now a gap in the marketplace for traditional telecom services to be delivered from the cloud — which is exactly what Alianza does.

Top 3 Cloud Communications Opportunities

Frost & Sullivan predicted major growth in the UCaaS market, projecting that demand in 2028 will be more than three times the seats in 2020, as customers migrate from legacy communication platforms, including traditional PBX systems, to cloud-based solutions. This transition is not limited to specific segments or verticals; it is happening across the board. According to a 2021 SMB Cloud Communications survey:

- 48% of businesses prefer adding collaboration services to their voice service, especially if their voice service provider can offer both.

- 87% of respondents preferred to buy phone and cloud communications services from their internet provider if the features met their needs.

In summary, market experts strongly believe that CSPs offering a comprehensive range of services are in a favorable position to win substantial market share.

The critical question then arises: To best capitalize on cloud communications opportunities, what types of solutions should you include in your portfolio? Here are some of the best options.

1. Home Phone Still Has a Place in Cloud Communications

The home-phone VoIP market continues to be lucrative for service providers. Despite the decline in fixed-line residential services, they remain essential for many end customers. CSPs see 15–30% home-phone take rates with broadband subscribers, and there are still over 46 million wireline voice subscriptions in the US market alone. CSPs can improve market performance by moving their residential services to the cloud and potentially adding compelling features.

Once moved to a cloud communications platform, enhancing residential phone services is straightforward, allowing CSPs to minimize churn and maximize revenue retention. Enhancements of existing residential phone packages include features like robocall protection, voicemail-to-email, and call-handling options like the ability to forward residential calls to mobile phones. Even though other vendors are ignoring this segment, the home phone market still holds significant revenue potential.

2. POTS Replacement is Happening

Many business-critical and life–safety systems are still running on degrading copper POTS lines, and while the replacement process is already underway, it will take time. Of the millions of POTS lines in the United States, 20–30% support specialized lines like elevator phones, alarm systems, fire panels, security gate lines, point of sale machines, and more. Fully managed cloud-based solutions enable service providers to offer a cloud connectivity replacement service that can support a variety of system requirements, including power and network redundancy, with little to no impact on existing business processes.

Tiered Offerings for Cloud PBX & UCaaS Solution

Cloud PBX and UCaaS solutions typically offer multiple service tiers that cater to diverse business needs. Service providers should consider UCaaS solutions that have the following functionalities:

- Voice-Centric Communication. Encompassing the essential telephony features that businesses require, cloud communication services like auto-attendants, call groups and queues, visual voicemail, and key PBX capabilities give modern businesses what they expect for streamlining their communication needs.

- UC Apps. With best-in-class applications designed for both desktop and mobile devices across iOS, Android, macOS, and Windows, users gain access to enterprise-grade messaging and seamless calling, which enhances their communication experience.

- Video Meetings. A comprehensive UCaaS solution should allow users to leverage multiparty video meetings with screen sharing, whiteboarding, and chat functionalities across various platforms.

Cloud-Sourcing Your Ideal Partner

If the notion of cloud sourcing a full stack of communications services is interesting to you, what might your ideal partner look like? I suggest looking for a cloud partner who provides a service-orchestration platform with robust integration capabilities that simplify the consumption, packaging, selling, and support of these services under the service provider’s own brand. This ensures a seamless experience for customers while allowing service providers to maintain their brand identity.

And who is the leading cloud communications partner today? It’s Alianza.

By partnering with Alianza, broadband providers can leverage the growing demand for telecom services and meet the evolving needs of their customers. It is through such strategic partnerships that service providers can capitalize on the cloud communications opportunities and remain competitive in the ever-changing telecommunications market.

Want to know more about your cloud communications opportunities? Book us now for a quick chat and let us show you why we have the ideal solution to your challenges.